According to data, the drop in Bitcoin’s price in early December increased the cryptocurrency’s daily trading volume.

According to Arcane Research’s most recent weekly report, the BTC daily trade volume increased by $15 billion on December 4th, the day of the meltdown.

The “trade volume” is a Bitcoin indicator that calculates the total amount of Bitcoin transferred on the chain on a given day. When the metric’s value rises, the market becomes more active as more holders exchange their coins.

On the other side, a declining value of the indicator indicates that few holders are transferring their coins. This might indicate that investors are now uninterested in the market.

High daily trading volume helps sustain large price movements. If the price of Bitcoin rises but the volume does not follow suit, the rally is generally short-lived. This type of ruse has been witnessed several times in recent months.

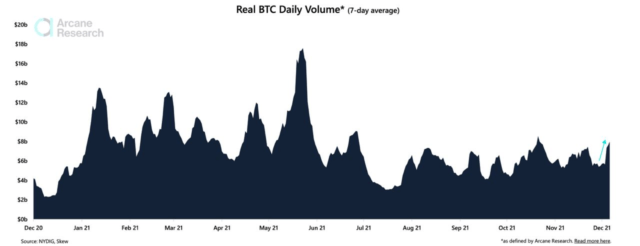

Now, here’s a graph that illustrates the value of this BTC indicator over the last year:

The graph above shows that the indicator’s value rose rapidly last week. On December 4th, the trade volume saw a significant $15 billion increase.

A BTC market meltdown driven by cascading long liquidations generated this abrupt steep surge in the metric’s value.

This jump in trade volume occurred on the weekend when the indicator normally assumes calmer levels compared to the rest of the week is intriguing.

Before this occurrence, everyday trading activity was quite low as BTC’s price slowed after reaching a new all-time high (ATH).

At the time of writing, the price of Bitcoin is hovering at $49.2k, down 14% in the previous seven days. The coin’s value has dropped by 23% in the last thirty days.

The figure below depicts the price trend of BTC over the previous five days:

Bitcoin appeared to be on the mend during the previous few days, as the cryptocurrency once again breached the $51,000 mark. However, the coin’s price appears to have dropped again today.