Today marks 13 years since the creation of the first block of the Bitcoin blockchain, known as the “genesis block.” To commemorate the occasion, we’re looking back at the economic conditions that spurred the birth of the first cryptocurrency, as well as the influence the digital asset has had on the world since.

Most people should be familiar with the term “genesis.” Genesis is the first book of the Hebrew Bible and the Christian Old Testament. It’s the name of a rock band led by Peter Gabriel from England. Even the name of a popular SEGA video game console. However, thirteen years ago today, the term “genesis” took on a whole new meaning.

According to Merriam Webster, the key definition is “the start of something.” The genesis block, commonly known as block 0 in the Bitcoin blockchain, is the exact beginning of the Bitcoin blockchain (though early versions of the code referred to it as block 1). It is the sole block in a blockchain that does not contain data that refers to a previous block.

However, there was something special within the coinbase specifications of that first block. “The Times 03/Jan/2009 Chancellor on the Verge of Second Bank Bailout,” served as both a timestamp and a hint as to why Bitcoin was founded.

The cryptocurrency was launched two months before the start of quantitative easing, a non-traditional monetary strategy aimed at stimulating the economy through an increased money supply. On the other hand, Bitcoin’s code restricts the asset to a fixed limit of 21 million BTC.

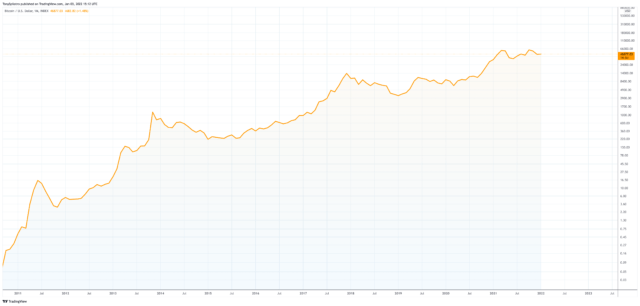

The M2 money supply doubled in the ten years following Bitcoin’s birth but has now gone parabolic upon the outbreak of the COVID pandemic. Throughout this time, the supply of BTC has remained constant, resulting in the unusual digital asset rising from near-zero to more than $68,000 per coin at its current peak.

The events that Satoshi may have predicted more than a decade ago may be to a head in the near future. Other Bitcoin projections include the asset potentially reaching hundreds of thousands to millions of dollars per coin. Contrarian forecasts predict that the asset will once again sink to zero.

Whatever side of the debate you are on, there is no disputing that today is a day to be celebrated. The Bitcoin network thrives more than ever thirteen years after the genesis block. Quantitative easing has gotten out of hand, resulting in record-high inflation.

Bitcoin, now a teenager and no longer a child, is maturing, but it is still many years away from adulthood. And, like a teen preparing for adulthood, it is now time for the asset to discover itself and its role in the macro world properly.